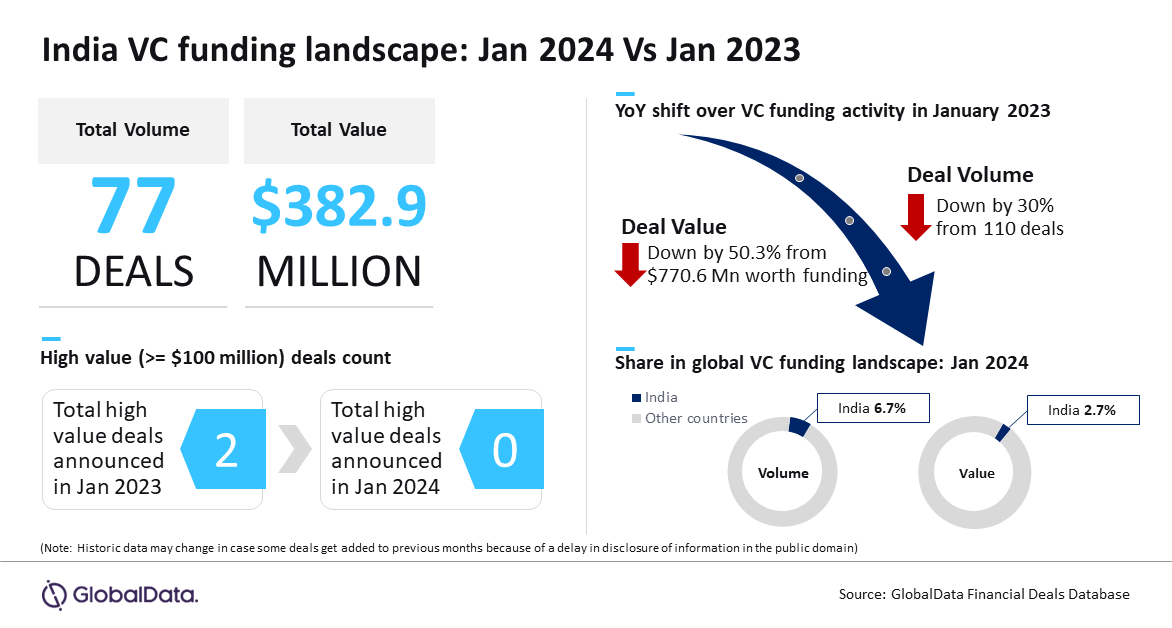

Venture capital (VC) funding activity in India experienced a decline both in terms of deal volume and value in January 2024 compared to January 2023. However, the impact was more prominent in terms of value. A total of 77 VC deals were announced in India during January 2024, while the disclosed funding value of these deals stood at $382.9 million. This represents a year-on-year (YoY) decline of 30% in terms of deal volume, whereas the corresponding deal value declined by 50.3%, according to GlobalData.

An analysis of GlobalData’s Deals Database revealed that Indian startups were able to raise a total of $770.6 million worth of VC funding across 100 deals during January 2023.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “The decline being more prominent in terms of value reflects the severity of investor cautiousness for big-ticket investments. Apart from several macroeconomic challenges and geopolitical conditions that have been impacting investor sentiments across most of the markets globally, concerns regarding valuations, profitability and business models of Indian startups also seem to be forcing investors to exercise more caution while placing their bets.”

The severity of the dent in investor sentiment while committing big investments can also be understood from the fact that India did not see the announcement of even a single VC deal valued more than $100 million during January 2024.

However, despite the setback, India still continues to be a key Asia-Pacific (APAC) market for VC funding activity and stands just next to China in terms of both deal volume and value. India accounted for a 15.5% share of the total number of VC deals announced in the APAC region during January 2024, while its share in terms of deal value stood at 9%.