- Chinese and Hong Kong stock exchanges escaped COVID-19 largely unscathed

- JD.com and NetEase have turned back home for secondary listings

- GlobalData anticipates several more secondary listings next six months

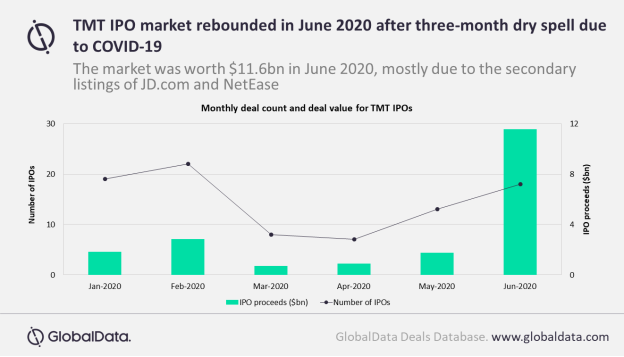

The increasingly volatile relations between the world’s two largest economies—China and the US—are forcing several Technology, Media, and Telecoms (TMT) companies across the Asia, especially in China, to head back home for secondary listings, says GlobalData, a leading data and analytics company.

Reportedly, the US Senate passed a bill in May 2020 to de-list overseas companies from US exchanges if they do not abide by the US accounting laws. Against this backdrop, the Chinese and Hong Kong stock exchanges are benefitting as JD.com and NetEase have turned back home for secondary listings.

US Senate bill can boost IPOs on Asian stock exchanges

Swati Verma, Senior Analyst of Thematic Research at GlobalData, comments: “The tightening of policies for overseas companies listed in the US is directed at China and Hong Kong-based companies. This could boost IPOs on Asian stock exchanges as Chinese companies raise capital elsewhere.”

GlobalData’s latest report, ‘IPOs in the Global Technology, Media, and Telecoms Sector – Thematic Research’, reveals that China was the second largest market—behind the US—for TMT IPOs between 1 January 2018 and 30 June 2020. During the period there were 125 flotations in China and Hong Kong, raising US$52.9bn.

Ms Verma explains: “The overall TMT IPO market was impacted by COVID-19, but the Chinese and Hong Kong markets escaped largely unscathed. The exchanges saw 41 companies getting listed in first half of 2020 compared to 21 in the first half of 2019. For the first half of 2020, IPOs in region accounted for 60% of all the capital raised by TMT.”

TMT IPO uptick due to secondary listings of JD.com and NetEase

The TMT IPO saw an uptick in June 2020 to US$11.6bn after the hiatus caused by the pandemic. The rebound was primarily due to the secondary listings of JD.com and NetEase. These companies followed Alibaba’s lead, which listed in Hong Kong in 2019.

Ms Verma concludes: “If the tension between the US and China exacerbates, the trend is likely to continue. China is already trying to attract TMT companies to its markets. In 2019, it had launched its Nasdaq -equivalent STAR market, which aims to boost domestic investment in TMT. As a result, GlobalData anticipates several more secondary listings from companies such as Baidu (Internet and services) and Trip.com(online travel) in the next six months.”