Deloitte warns of a potential spike in bribery and corruption across Asia Pacific in the wake of COVID-19. Launching the Deloitte Bribery and Corruption Report 2020, the professional services firm warned that the unique and intense commercial pressures from the Coronavirus outbreak have increased the bribery and corruption threat for companies, their workforces and executives.

“As markets reel from the impact of COVID-19, uncertainty and anxiety may well trigger an increase in risky behaviour,” Oliver May, Forensic Director Deloitte said.

“As the threat to livelihoods accelerates, so do the vulnerabilities to dishonesty. Fraudsters, cybercriminals, organised crime groups and corrupt individuals will test your organisation’s commitment to integrity. Employers need to support their people, organisations and the wider community by making sure they have anti-bribery policies and programs in place.

“Our report identifies the current areas of vulnerability across the region and offers approaches as to how best to mitigate them.”

Deloitte’s survey of 159 corporate, government and not-for-profit leaders across Australia and New Zealand presents seven key insights, with some stark findings including:

- One in 20 Australasian organisations have unclear approaches to bribery which do not specify ‘no tolerance’

- Australasian organisations worry more about their people receiving, than paying bribes

- Some significant growth in conflicts of interest over the past five years.

Chris Noble, Managing Partner Deloitte Forensic Asia Pacific said: “Across Australasia and the Asia Pacific region, I encourage business leaders to recognise this time as one where your ethics will be well and truly tested.

“Clear, confident, unequivocal communication is so important to ensure the sustainability of your business and protect its reputation. The decisions leaders make now will affect their organisations long after the crisis has passed. We must make the right ones, and I encourage you to consider how the insights in our report can be used to protect your people and your business.

“The reality is that the 2020 Deloitte Australia and New Zealand bribery and corruption survey leaves no doubt that Australia’s reputation has slipped over the last two years.”

‘Corruption’ captures a range of forms of dishonesty, including conflicts of interest and nepotism. The Deloitte Report lists some actions to consider.

Most respondents to the Deloitte survey[1] were from Australia and New Zealand, with many of their organisations operating supply chains and markets across the Asia Pacific region. May said: “Given that corruption risk can manifest in different forms across this remarkably diverse region, Australasian companies need to understand those environments and the multitude of different standards that pertain in each jurisdiction.”

The Deloitte Bribery and Corruption 2020 Report – Navigating with Confidence points to risk sensing as a key to assisting all those organisations operating in the region.

The Deloitte Bribery and Corruption 2020 Report – Navigating with Confidence points to risk sensing as a key to assisting all those organisations operating in the region.

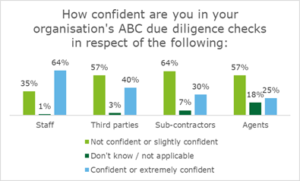

May pointed out that: “Moving away from a ‘best guess’ estimate to carefully examining operations and shoring up the gaps is important. More informed due diligence assisted by new data analytics technologies will help organisations be more confident as they navigate their supply chains and markets. Some of the survey findings do give us cause for concern.”

Data Analytics is still in the hands of early adopters. Remarkably, given the breadth of available technology, only 9% of respondents with known incidents use detection data analytics. “Australasian organisations need to seize the opportunity to gain early warning of incidents and better understand their increasing risk indicators,” said May.

Culture is king, but few organisations are adequately investing. While most respondents see culture as their primary focus over the next two years, only 27% reported a clear investment in anti- bribery and corruption cultures.

Culture is king, but few organisations are adequately investing. While most respondents see culture as their primary focus over the next two years, only 27% reported a clear investment in anti- bribery and corruption cultures.

Noble added: “Corruption resilient and bribery aware cultures require investment. Australasian organisations need to understand their risks and invest in managing them accordingly.”

[1] 159 senior responders to the anonymous Deloitte survey between October and December 2019, included CEOs, CFOs, CROs, general counsels, and risk and investigation managers from a cross section of industries across the ASX200 and NZX50, public sector, Australian and New Zealand subsidiaries of foreign companies, not for profits, and other listed private companies.

Deloitte also undertook interviews with additional leaders across Australia and New Zealand and obtained insights from Deloitte subject matter experts across Asia Pacific.