In line with the global trend, deal activity in the Asia-Pacific (APAC) region also declined year-on-year in the first four months of 2023.

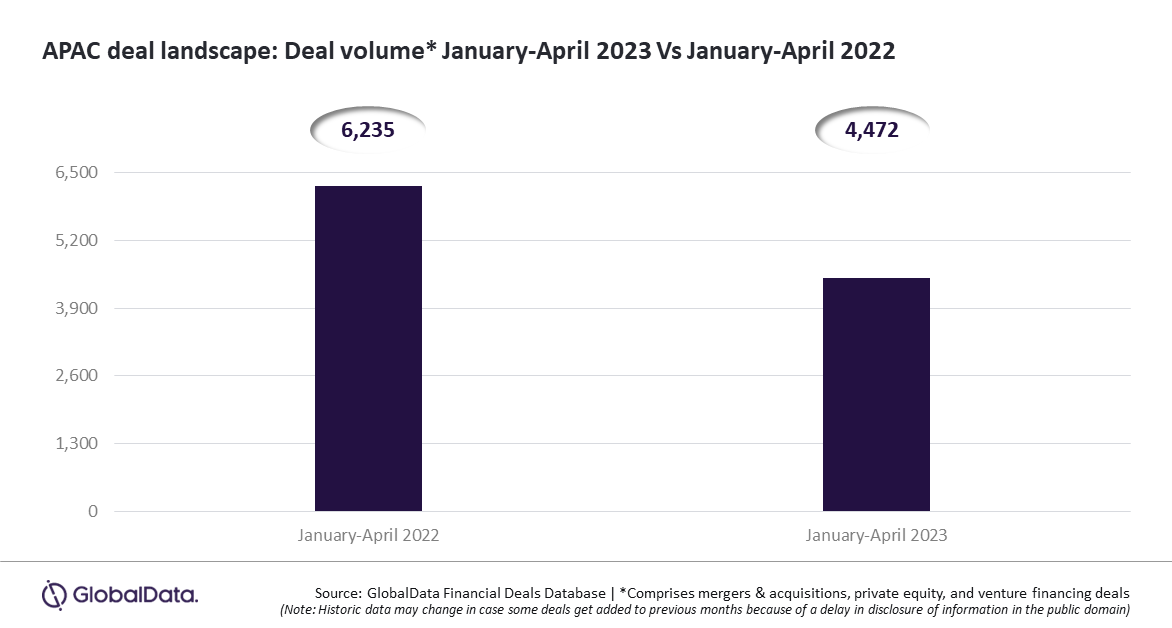

A total of 4,472 deals* were announced in the APAC region during January to April 2023, which represents a decline of 28.3% over 6,235 deals announced during the same period in 2022, finds GlobalData.

An analysis of GlobalData’s Financial Deals Database revealed that all the deal types under coverage witnessed a decline in deals volume during January-April 2023 over the number of deals announced during January-April 2022.

The volume of merger and acquisitions (M&A), private equity, and venture financing deals in the APAC region fell by 20.1%, 27.8%, and 34.5% year-on-year during January-April 2023.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Although the deal activity in the APAC region was in line with the global trend amid volatile market conditions, it was relatively better compared to other regions.”

For instance, North America, the Middle East & Africa, and South & Central American regions saw deals volume declining by 33.9%, 32.4%, and 36.9% in the four-month period, compared to January-April 2022, respectively. This is higher compared to the decline in deals volume experienced in the APAC region.

Bose adds: “This is, in part, due to China, which is the key APAC market and the second largest globally in terms of deals volume, registering a decline that was relatively lesser than its peer countries in other regions.”

China experienced a decline in deals volume by 18.2% during January-April 2023 compared to the same period in 2022, while the decline experienced in the US (which is the top market globally in terms of deals volume) stood much higher at 35.3%.

Other APAC markets such as India, Japan, Australia, South Korea, Singapore, Malaysia, Hong Kong, Indonesia, and New Zealand witnessed a decline in deals volume by 38.5%, 23.4%, 26.1%, 42.3%, 33%, 8.1%, 32.5%, 47.9%, and 50.6% year-on-year during January-April 2023, respectively.

*Comprising mergers & acquisitions, private equity, and venture financing deals.